crypto tax accountant canada

Also for those considering implementing crypto tokens and currency in their business. Our clients can focus on their core business and leave crypto accounting services of crypto tax accountant Canada.

Best Crypto Tax Software For 2020 Top Bitcoin Accounting Service Providers Programs For Taxes Master The Crypto

Crypto might seem complicated - but accountants shouldnt be put off by a lack of understanding of the cryptoverse because crypto accountants have never been more in.

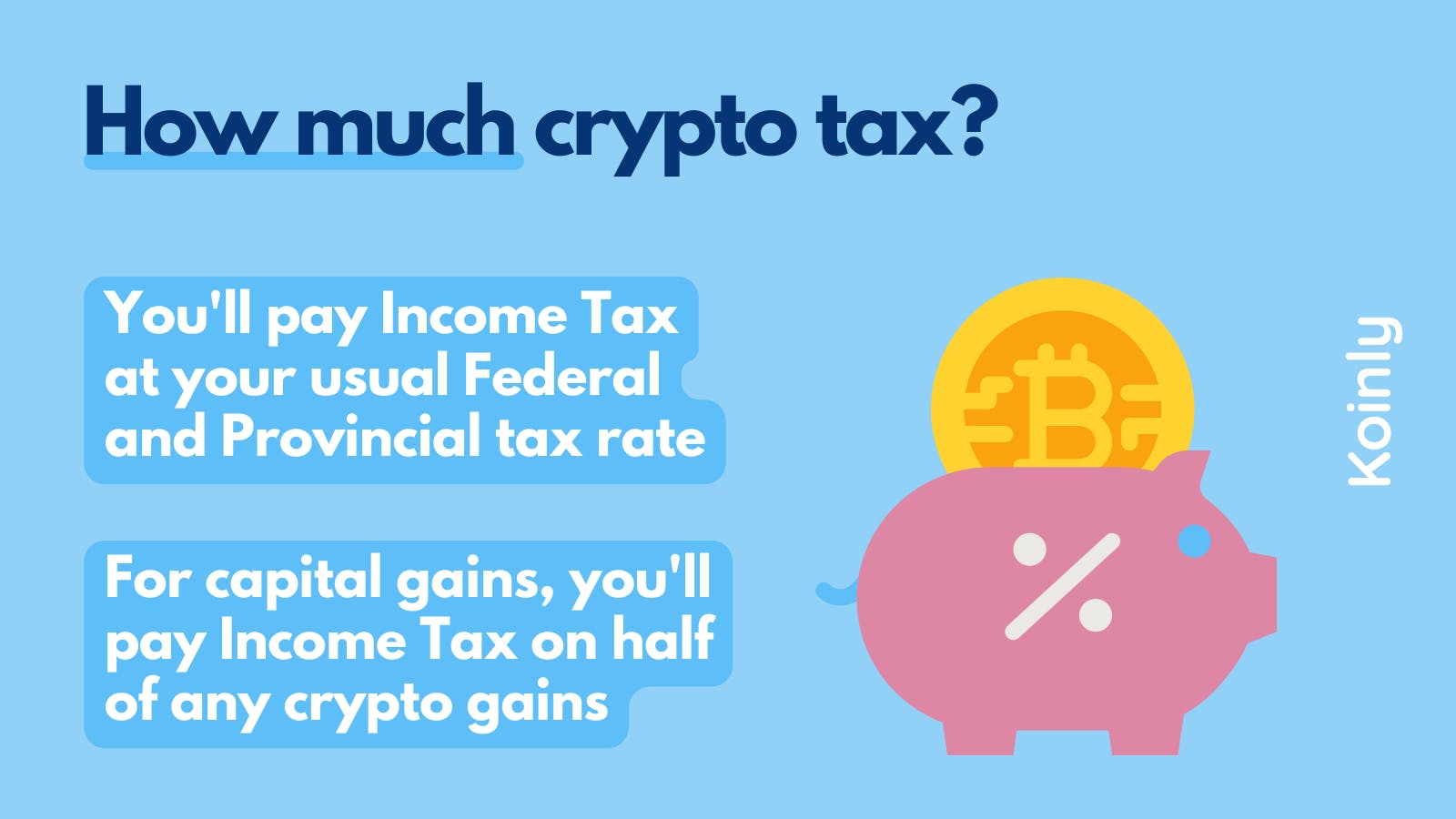

. Since he purchased the BTC back in 2020 for 20K CAD he has now realized a gain of 40000 CAD. If the CRA is auditing you for NFT or crypto taxes it is in. Our experts are well versed in calculating cryptocurrency transactions and its tax implications.

And unfortunately there are a lot of scammers and charlatans. The CRA initiates crypto tax audits with a letter notifying the taxpayer and a 13-page cryptocurrency audit questionnaire. Have more questions about cryptocurrency accounting.

We offer an extensive range of crypto taxation and accounting services. Our directory of CPAs tax preparers and tax attorneys helps crypto traders help find a knowledgeable tax accountant for crypto tax advice planning and tax returns. How is crypto tax calculated in Canada.

As always were here to help if you do have any questions so feel free to reach out. Deixis is a crypto accountant in Canada that starts you off with a crypto assessment. Do you handle non-exchange activity.

Book a call today to discuss your crypto tax situation and protect your investment. Tax Partners has been in business for over 39 years. We also have a complete accountant suite aimed at accountants.

That way youll have peace of mind knowing your crypto taxes are done right. We handle all non-exchange activity. We are the first blockchain accountants in Canada and have been working with a lot of different companies from the Co-founder of.

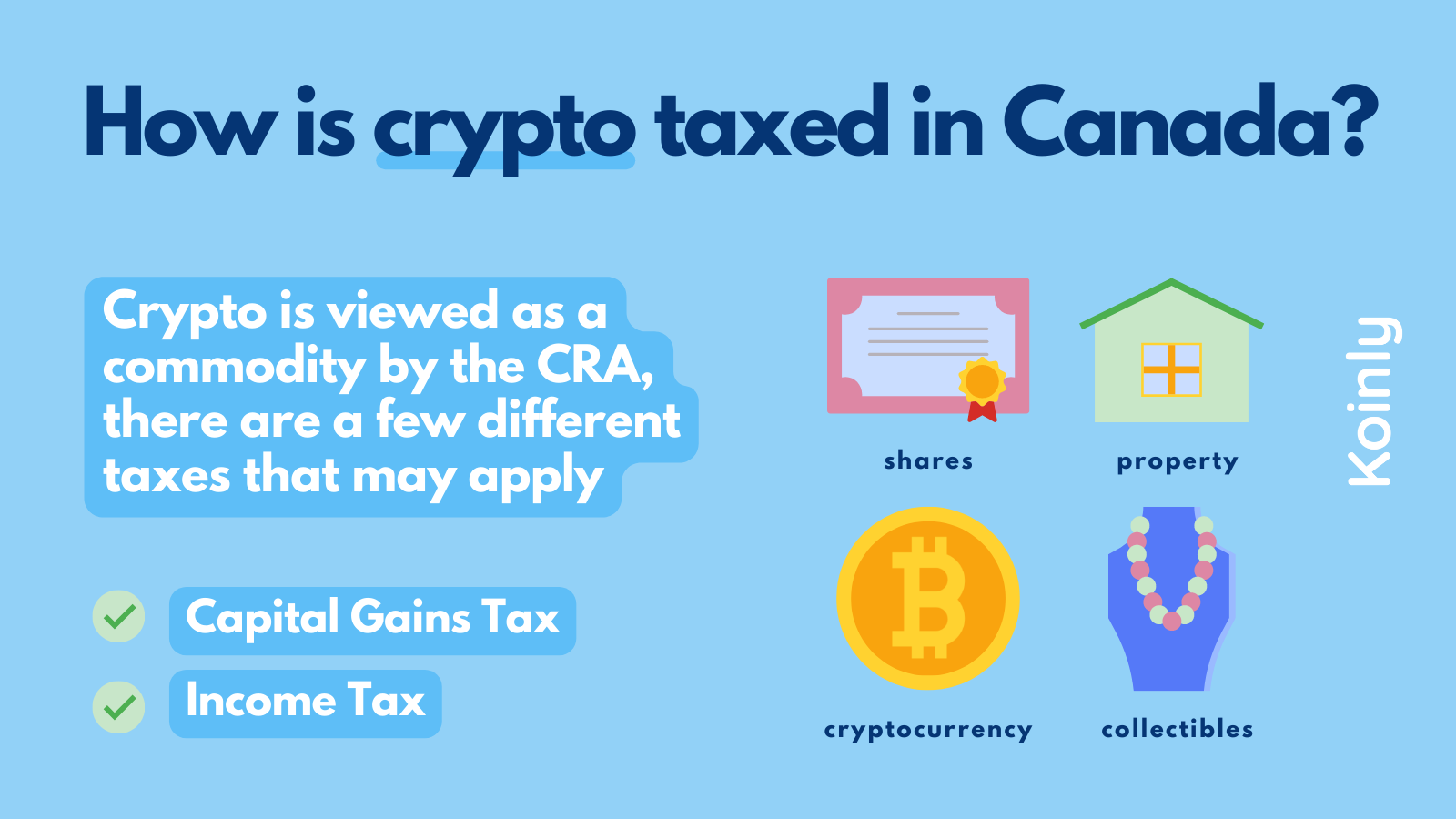

Perhaps this is your first tax year with crypto asset gains in which case we will also help you with high quality reports from the start. The way your crypto earnings get taxed in Canada depends on how the CRA classifies your crypto. Talk to Crypto accountants in calgary.

This gain is something that Bob would have to report on his income tax. The crypto space is still very new and there arent too many qualified tax accountants who specialize in it. Our team of experts has years of experience with cryptocurrency taxes and we can help ensure that you pay the right amount of tax on your cryptocurrency gains.

Take the burden off. Koinlys industry leading crypto tax software offers all the tools you need to impress your crypto investor clients catapult your business revenue. MetaCounts is Canadas premier crypto specializing accounting firm and have helped numerous crypto investors figure.

Also for those considering implementing crypto tokens and currency in their business. For those who need to find out if you have made or lost money trading cryptos. For those who need to find out if you have made or lost money trading cryptos.

We verify each and every crypto tax accountant in our directory. We are leading crypto tax accountants in Toronto. If this is you then its time to get help.

How To Calculate Your Crypto Tax In Canada

Cryptocurrency Tax In Canada Cra Bitcoin Tax Crypto Tax Canada

How To Report Cryptocurrency On Taxes Crypto Income Taxes Zenledger

.jpg)

7 Foolproof Tactics To Avoid Crypto Taxes In Canada Coinledger

Cryptocurrency Tax Lawyer Accountant Canada Crypto Tax Lawyer

Blockchain Cryptocurrency Specialists Metrics Chartered Professional Accounting

Canada Crypto Tax The Ultimate 2022 Guide Koinly

The Investor S Guide To Canada Crypto Taxes Coinledger

How Do You Deal With Cryptocurrencies As Accountants Mercer Bradley

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Tax Implications Of Cryptocurrency Hard Forks

Cryptocurrency Tax Accountants Coinpanda

Canadian Tax Implications Of Bitcoin And Crypto Assets

2022 Canadian Crypto Tax Guide The Basics From A Cpa R Bitcoinca

A Canadian Tax Guide For Cryptocurrencies Faris Cpa

Do I Pay Crypto Taxes In Canada 2022